property tax loans florida

Again if you dont pay your property taxes in Florida the delinquent amount becomes a lien on your home. 3 Oversee property tax administration.

A Summary Of The Florida Intangible Personal Property Tax

If Tampa property taxes have been too costly for your wallet causing delinquent property tax payments you can take a quick property tax loan from lenders in Tampa FL to save your property from a potential foreclosure.

. Tax amount varies by county. A wife deeds her homestead Florida real property to herself and her husband. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

List of florida property tax lenders by county. In developing its annual corporate income tax piggyback bill the Florida Legislature is considering the impact of conforming to 2020 federal tax changes adopted by Congress through the Coronavirus Aid Relief and Economic Security CARES Act of 2020 and Consolidated Appropriations Act. The amount of an obligation secured by a mortgage on Florida real property and.

Stat provides that improvements can include energy efficiency renewable energy and wind resistance improvements. 150000 x 0002 300 tax due. Property owners could only start to realize the economic benefits of energy efficiency retrofits after the loan had been fully repaid.

And then they collect another 58 million in bond debt payments. Here are the median property tax payments and average effective tax. Property tax lenders broward county fl.

Title loans Mortgages Liens and Other Evidences of Indebtedness Documentary stamp tax is due on a mortgage lien or other evidence of indebtedness filed or recorded in Florida. At a 083 average effective property tax rate property taxes in Florida rank below the national average which currently stands at 107. Find Lenders in Your Area Now.

1 day agoThe Florida House of Representatives voted Thursday to disband the Reedy Creek Improvement District. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Competing bills currently under consideration by the Senate.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. The tax rate is 35 per 100 or portion thereof and is based on the amount of the indebtedness or obligation secured even if the indebtedness is contingent. The corresponding negative cash flow was a problem for both property owners and the lenders.

Florida real property tax rates are implemented in millage rates which is 110 of a percent. Once theres a tax lien on your home the tax collector may sell that lien. Median annual property tax bills in the Sunshine State follow suit as its 2035 mark is.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Overview of Florida Taxes. Reedy Creek brings in about 105 million in general revenue through property taxes every year.

Ad Get Up to 100000 in to Buy Land. Get Your Rate Instantly. Ad Apply for a No Hassle Quick Easy Personal Loan.

A short-term loan usually resulted in debt service that would exceed the utility cost savings. Its easy to pay off your property taxes when you call tax ease. Fixed APR from 349.

We always look for reputable property tax lenders to add to our Floridas vendor list. We can secure property tax loans for personal homes investment homes condos land or a commercial building. This equates to 1 in taxes for every 1000 in home value.

Title loans mortgages liens and other. The value of the property is 150000. The property is encumbered by a mortgage and there is no other consideration for the property interest transferred.

We can handle loans from 10K to 100K or more if you have a free and clear property in Florida. Please consider AHL Hard Money Network when your taxes are late or you are at risk of losing your property. Get a Line of Credit in as Little as 24 Hrs.

407 number of taxable units representing each 100 or portion thereof of the consideration of 40675 x 70 28490 tax due. The amount of an obligation solely secured by a mortgage on Florida real property is 151250. So about 163 million of liability every single year.

Simply Answer a Few Questions to Get Matched. If Homestead property tax rates are too high for you causing delinquent property tax payments you can take a quick property tax loan from lenders in Homestead FL to save your home from a potential foreclosure. APPLY TO GET LISTED.

Best Loan Companies for Land. The tax collector transfers the tax lien to the property tax lender and that is the lenders security for getting paid under the payment plan. Each year the Florida Legislature must consider adopting the current Internal Revenue Code IRC Title 26 United States Code to ensure certain tax definitions and the calculation of adjusted federal income will be consistent between the Internal Revenue Code and the Florida Income Tax Code Chapter 220 Florida Statutes FS.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Compare Offers Apply. As described above the documentary stamp tax will be an amount equal to 35 cents per 10000 of the amount financed unless the loan amount is 70000000 or more in which instance the maximum amount of tax.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Contact AHL Hard Money Network today for more.

If Florida property tax rates have been too high for your wallet causing delinquent property tax payments a possible solution is getting a quick property tax loan from lenders in Florida to save your property from a looming foreclosure. 097 of home value. PACE loans are property assessed clean energy PACE programs that allow a property owner to finance energy efficient or wind resistance improvements through a non-ad valorem assessment repaid through the annual tax bill.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property. Fast Easy Approval. Loan executed in Florida not secured by Florida real property Only documentary stamp tax will be due since there is no Florida real property collateral.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in the state of Florida apply to get listed on our directory. If Lakeland property tax rates are too high for you causing delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Lakeland FL to save your property from a looming foreclosure. Florida Property Tax Lien Sales and Tax Deed Sales.

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

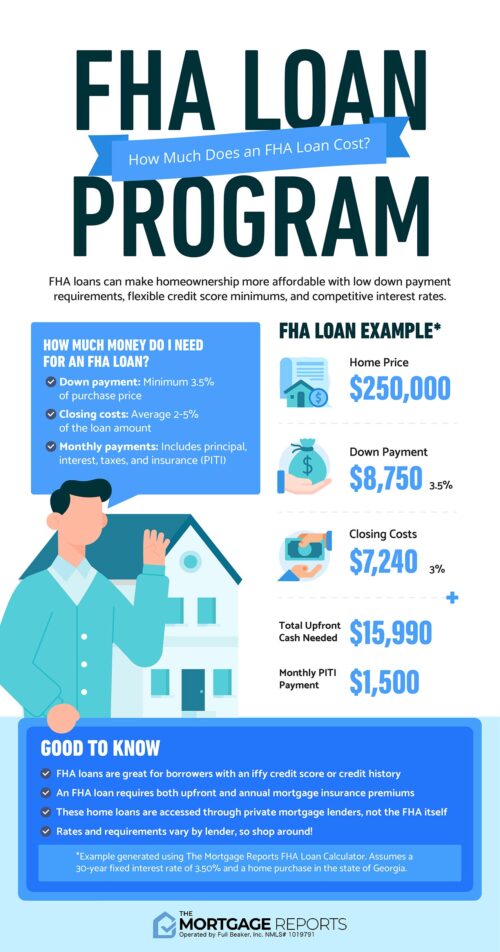

Fha Loan Calculator Check Your Fha Mortgage Payment

Your Guide To Prorated Taxes In A Real Estate Transaction

Deducting Property Taxes H R Block

Soaring Home Values Mean Higher Property Taxes

What Are The Taxes On Selling A House In New York

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax Exemptions Available In Florida Kin Insurance

Florida Property Tax H R Block

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

The Risks Of Purchasing A Florida Property In A Tax Sale Business Law Real Estate Immigration Litigation Probate 305 921 0440

How To Get A Florida Fha Loan First Time Home Buyers Guide

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Va Lending And Property Tax Exemptions For Veterans Homeowners

Property Taxes Calculating State Differences How To Pay

Property Tax How To Calculate Local Considerations

Property Tax Exemptions Available In Florida Kin Insurance